SuperMoney, and/or SuperMoney's lending partners, that will not affect your credit score. † To check the rates and terms you qualify for, one or more soft credit pulls will be done by Service provider and read the information they can provide. We endeavor to ensure that the information on this site is current and accurate but you should confirm any information with the product or Represent all financial services companies or products.

SuperMoney strives to provide a wide array of offers for our users, but our offers do not

(including, for example, the order in which they appear).

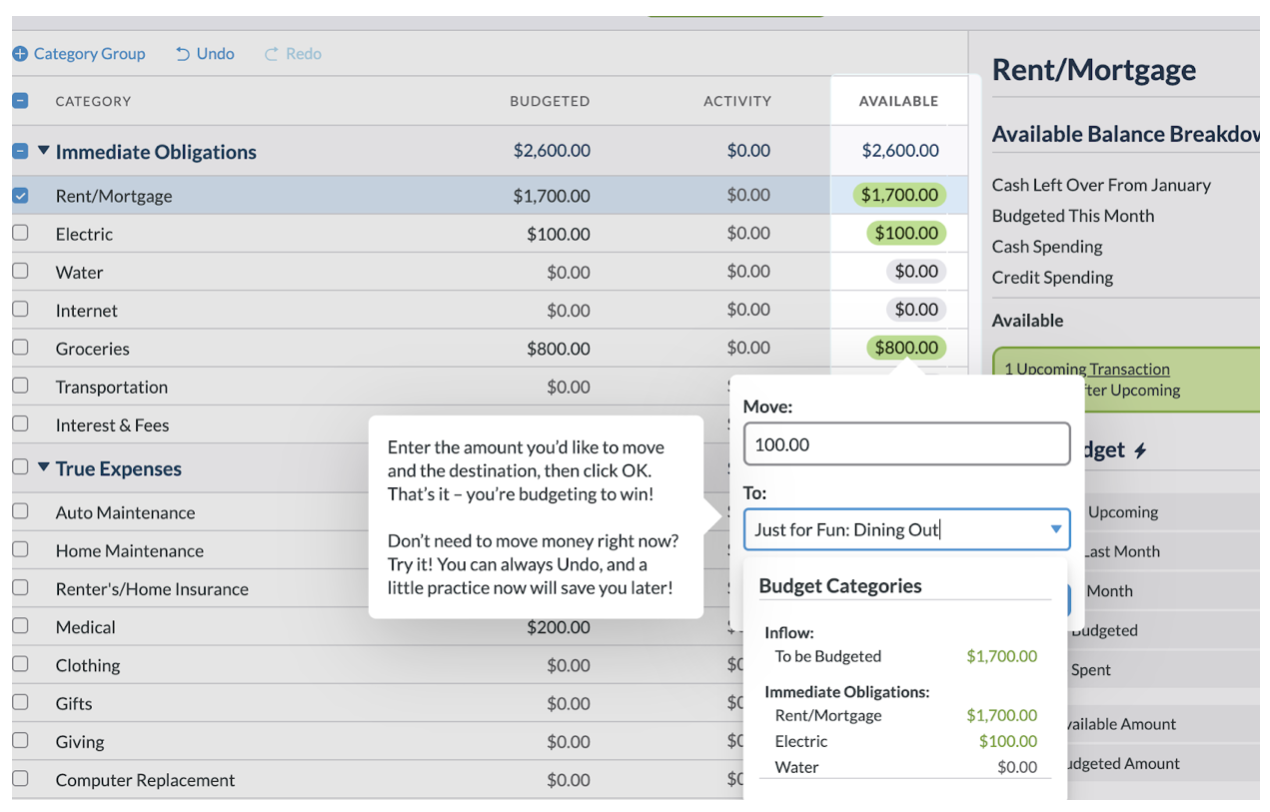

This compensation may impact how and where products appear on this site Sponsored products and services, or your clicking on links posted on this website. The owner of this website may be compensated in exchange for featured placement of certain is an independent, advertising-supported service. This content is not provided by any financial institution. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone,Īnd have not been reviewed, approved or otherwise endorsed by any financial institution. Their use does not signify or suggest the endorsement,Īffiliation, or sponsorship, of or by SuperMoney or them of us. Failing to do so could otherwise throw you for a loop when the. This budgeting method helps you be intentional about where your money goes.īelow, we review the You Need A Budget (YNAB) app to give you all the details on its features, including the tools, perks, safety, pricing, availability and ratings so you can decide if it is the right app for managing your money.*SuperMoney is not responsible for third party products, services, sites, recommendations, endorsements, reviews, etc.Īll products, logos, and company names are trademarks™ or registered® trademarks of their respective holders. For example, if you pay your homeowners' insurance once a year and it costs 600, you'll need to budget 50 a month for that expense. This is known as the "zero-based budgeting system," where you assign every dollar a purpose in your budget. Instead of using traditional budgeting buckets, YNAB users map out a plan for every dollar. Out of a dozen-plus apps that CNBC Select compared when rating the best budgeting apps and best expense tracker apps, YNAB stood out for being the best app for serious budgeters. If you're the latter, then the You Need A Budget (YNAB) app is for you. Maybe you need an app that can also help curb your spending, save you money and put you on the fast track to debt payoff. Think about whether you want help tracking your incoming and outgoing cash, or if you want more than that. Consider your needs before settling on just any free budgeting app.

0 kommentar(er)

0 kommentar(er)